- Futuristic Digital Wealth Agency

- Posts

- 🚀 Credit Mastery Course Study Now Available

🚀 Credit Mastery Course Study Now Available

Leveraging Federal Law to Seize Consumer Power

Govt Shut DownI think now be the best time to start corrrecting all affairs with the credit and banking system. The main laws that protects a consumer is FEDERAL LAWS & STATUES. We need not to be blind by the distractions but proactive with solutins and one solutions to alot of everyday citizens is fincial issues and credit might be one of them. |  |

Not Another Course

Research is key to elevating ones self knowledge

CONSUMER LAW IS AT RISK BUT IT IS STILL LAW!

I really do not know what to say for us in what we call America today, even laws are being chnaged but law is the land and we still might have some time where we can still use the law to prtect us on this land and as the Consumer.

"These are some of the Federal laws that govern us, the consumer, pertaining to all consumer transactions. Why I say specifically consumer transaction instead of credit or debt, is that anything that deals with us using our social security number is considered a consumer transaction and/or an extension of credit."

will cover that in another episode.

Federal Trade Commission Act (FTC Act): A primary consumer protection law that prohibits "unfair or deceptive acts or practices" in commerce. It established the Federal Trade Commission (FTC), which enforces consumer protection laws and seeks to prevent false advertising and other misleading business practices.

Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act): Passed in response to the 2008 financial crisis, this act reformed the financial industry and created the Consumer Financial Protection Bureau (CFPB) to enforce regulations for consumer financial products and services.

Credit, lending, and financial services

Truth in Lending Act (TILA): Requires lenders to provide clear and accurate disclosure of credit terms and costs, such as the annual percentage rate (APR), so consumers can compare offers.

Fair Credit Reporting Act (FCRA): Regulates the collection, dissemination, and use of consumer credit information. It gives consumers the right to access their credit files and to dispute inaccurate information.

Fair Credit Billing Act: Helps consumers resolve billing disputes with credit card issuers and protects them from being held responsible for fraudulent charges.

Equal Credit Opportunity Act (ECOA): Prohibits creditors from discriminating against applicants on the basis of race, color, religion, national origin, sex, marital status, age, or because they receive public assistance.

Gramm-Leach-Bliley Act (GLBA): Requires financial institutions to explain their information-sharing practices to customers and to protect sensitive data.

Electronic Fund Transfer Act (EFTA): Establishes the rights and liabilities of consumers and financial institutions involved in electronic fund transfers.

Debt collection

Fair Debt Collection Practices Act (FDCPA): Prohibits third-party debt collectors from using abusive, unfair, or deceptive practices when collecting consumer debts.

50-60+ Federal consumer protection programs affected

Why This Matters to YOU as a Consumer; federal laws are SUPPOSED to protect you. Right now? Those protections are WEAKENED or GONE.

SEE HOW LOCALS STYLE WITH PURPOSE →

The Legal Leverage

Understanding Deceptive Practices

The whole thing ima be honest is illegal and corrupt… So what? What are you doing? So to always know when not to be conned you have to learn the game. Spot the gimmick, and when you do you then will have the abiliy to change the odds in the game.

Here basically the set up and law priciples:

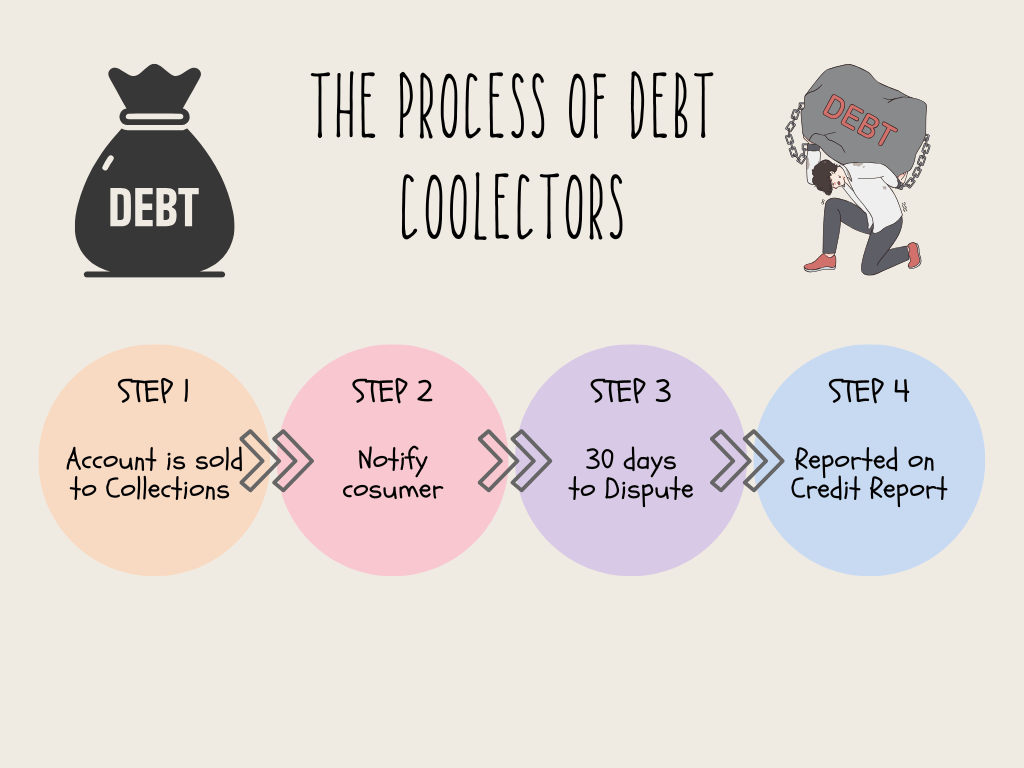

If you dnt contest, fight or dispute - you basically admit to the debt and except all alllegations. Debt and Credit is just paperwork, what happens is this paperwork then gets sold without your knowledge or permission, and anyone can buy and claim, and if you dont know or dont contest within a certain time frame (30 days for most stuff) up now i can make you pay me or sue.

And the average 60 million regualar citizens dont know this. And of course it gets into a deeper rabbit hold then just that.

Court Civil SuitPeple think suing a company is hard, its all about evidence and stating 3 things. |  How Its Suppose To Go.The proper way to notify a consumer, the process and where you? |

ERRORSWhat is an error or violation on your credit reports? |  FUNCTION MEETS FEELINGDesigning with intention: when beauty and utility coexist. |

Artificial Intelligence

THE REAL HIDDEN PROBLEM [CURSE OR GIFT]

What does this all have to do with? = Information and you better use it! Why? People can now access an intelligence that is as smart as all computers. You then, let's say, give it a person's credit report and it can tell you the errors. You then can get it to correlate with all the consumer laws, and then use it to structure a way to research laws on this, fight in court and have the information to back it.

Imagine if just 2 million people started doing this and fighting back legally and then knowing what to do the next time? They make over 12 billion dollars from the credit and debt industry. They do not want people to know this and put a dent in that.

And that's just in the reference of credit and consumer law…. Imagine what other things people are doing and creating.

For me, I built a web app for credit repair with AI and AI agents. I'm using it to learn and adapt before the time comes where you will not have the freedom or access to. Try out

Claim Your Power

How to apply this information

Now is the time to translate this knowledge into action. The core concepts of legal status, mandated accuracy, and federal enforcement are central to the Credit Mastery Course curriculum.

To enroll in the complete AI-enhanced credit repair system for the discounted price of $50, visit: CREDIT MASTERY COURSE STUDY

A Final Note

I AM SEEKING TO PARTNER AND TEAM WITH LIKE MINDED INDIVIDUALS

Contact us if you want to acquire more information on our community

Email: [email protected]

Comment, Subscribe, Share, adn if need dhelp with Credit and/or AI reach out anytime.

“Knowledge is power, only when applied”

Until next time,

Futuristic Digital Wealth

1